Security should be given special attention primarily when it comes to the reliability of cryptocurrency funds. Today we will consider multisig as the most reliable way to keep your crypto assets from being stolen.

When did multi-signature technology appear?

Multisig technology was first implemented in bitcoin addresses in 2012. The first wallet with a multi-signature function was created in 2013. Currently, there are more than a dozen of them.

How does it work?

Access to funds stored on a multisig-wallet is possible only when two or more signatures are provided simultaneously. A simple analogy is a safe deposit box or safe with two locks and two keys. Thus, multisig-wallets provide an additional layer of security. With this technology, users can avoid the problems that often arise with single-key wallets that have a single point of failure and are vulnerable to attacks from cybercriminals who are constantly developing new phishing techniques.

Since multisig-wallets require more than one signature to move funds, they are also suitable for businesses and corporations looking to store funds in shared wallets.

Unlike single-key, funds stored in a multi-signature address can only be moved if multiple signatures are provided (by using different private keys). Depending on how the multi-signature address is configured, a different combination may be required: the most common is the 2-of-3 key, where only 2 of them are sufficient to access the means of a 3-signature address. However, there are many other options such as 2-of-2, 3-of-3, 3-of-4, etc.

Main Purpose

The purpose of making the signature of operation more complex is to separate responsibilities or improve security.

Sharing of responsibility implies that several people must collectively decide to transfer funds. And their decision is recorded using a personal digital signature. An example is a situation where a company has two or more owners. To spend a significant amount, they must come to an agreement, even being located in different areas.

Security using multisig is achieved due to the fact that the keys required for signing are stored on different devices. In order to take possession of funds, an attacker must gain access to two or more devices associated with a cryptocurrency wallet, which contains other private keys.

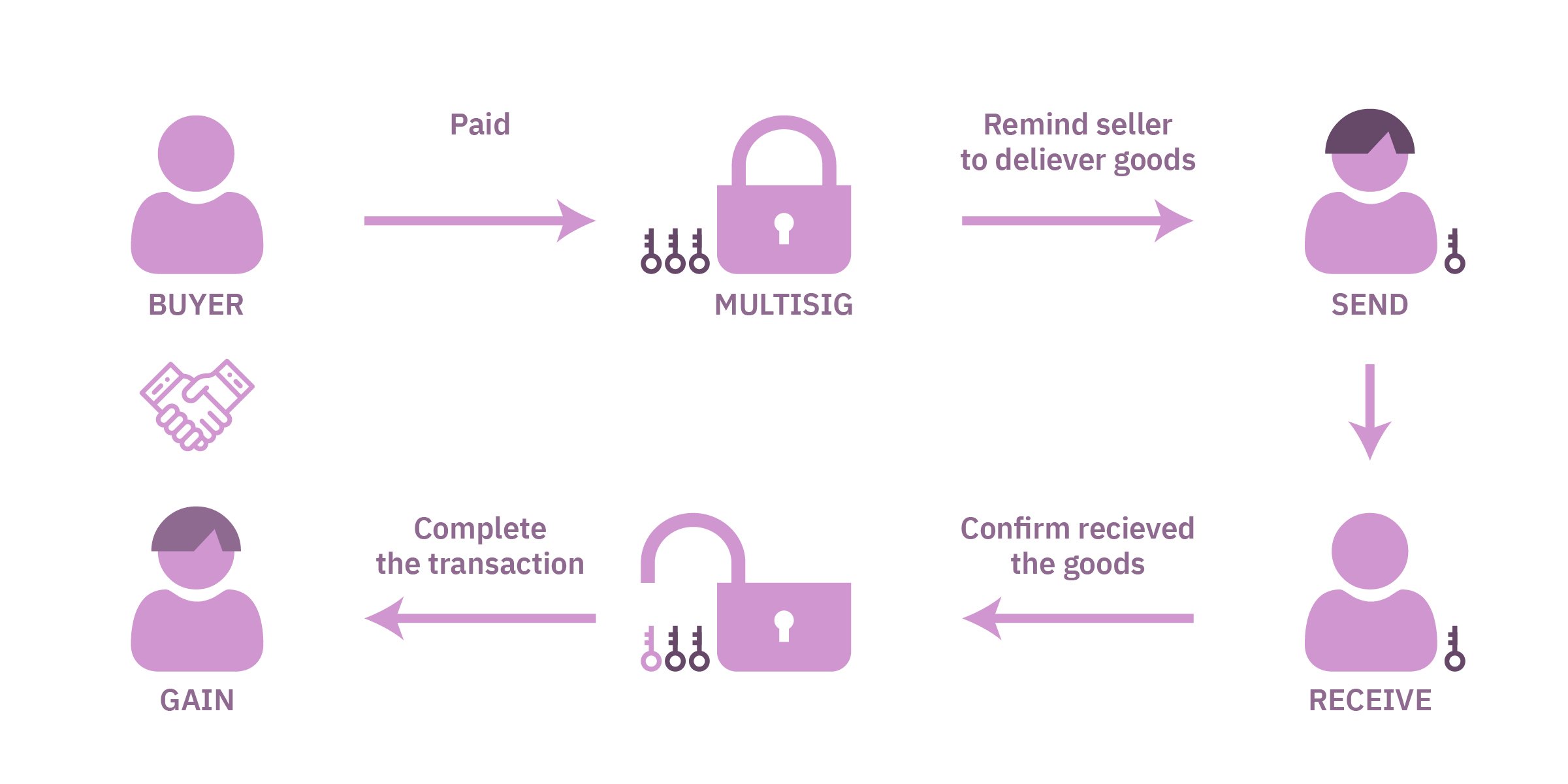

Another use case for multisig is trade security. When the seller does not trust the buyer (and vice versa), the transaction takes place on conditions when both participants in the transaction must confirm that it took place. Usually, a deposit account is used for this. It can be owned by a third party acting as an arbiter or by both parties to the transaction. But the principles on which the deposit is used have significant differences. The escrow account can be paid the amount of the payment for the goods or the deposit (additional funds). If a third party is involved in the process, then he can redirect payment to the seller after the buyer confirms receipt of the goods. Or return the amount to the buyer if the goods did not arrive. There are various disadvantages to organizing such a triple deal like some of the specific rights of the verifier or the cost of such service.

Popular cryptocurrency wallets with multisig option

A large number of modern crypto wallets provide a multisig function. Different projects implement it differently. Some of them provide the right to store private keys directly to the user. Others store the private key on the wallet server, but it is encrypted with a password and only its user knows it.

The most mentioned multi-signature cryptocurrency wallets are:

- Armory - users control their private keys themselves without relying on the wallet server or third-party servers. It allows users to create tiered addresses using the Lockboxes feature. It provides a maximum 7-of-7 ratio for signing transactions.

- Electrum - supports integration with third-party hardware wallets for storing private keys. Provides up to 15-of-15 signatures.

- Copay - users are responsible for their own private keys. No hidden or third-party servers are used. Provides up to 2-of-3 multi-signatures for signing transactions.

- BitGo - here users can store tiered addresses in the Ledger Nano S and Ledger Blue hardware wallets. It provides up to 3-of-3 multi-signatures.

- Coinbase has two options for storing private keys - on its servers and on the user's own. The wallet uses a 3-key architecture (Coinbase key, public key, and user key). The maximum scheme is 3-of-3.